Secondary Market Research: Key Insights for Better Decisions

Every research effort begins with a choice: narrow the field first, or commit before the landscape is clear.

Markets already contain traces of what works, what stalls, and what never takes off - scattered across reports, filings, conversations, and past attempts. Ignoring those traces doesn’t make a strategy bolder. It makes it uninformed.

Secondary market research exists to establish that foundation before momentum sets in.

In this article, we’ll clarify what secondary market research is, when it matters, where its signals live, and how to act on them - starting with the distinction between primary and secondary research.

TL;DR

- Secondary research saves time and money by using existing data to validate demand and avoid costly mistakes.

- It’s perfect for quick decisions, spotting industry shifts, and tapping into unused internal data.

- Focus on patterns in data - repetition is valuable, contradictions need further investigation.

- Tools like HappyScribe turn recorded feedback into searchable text, uncovering hidden insights.

- Use secondary research to make informed decisions and guide your strategy forward.

Secondary vs. Primary Research - The Real Difference

The real difference between secondary and primary research is decision gravity.

- Secondary research answers “Should this even be pursued?”

- Primary research answers “Can we commit to this with confidence?”

Primary research is when you go out and collect new data yourself. You run a survey, conduct interviews, test a prototype, or observe how people behave in a specific environment. You control the questions, the sample, and the method. It's built for your exact situation.

Secondary research is when you use data someone else has already collected. That could be a government census, a competitor's earnings call, an industry report, or even notes from your own team's customer calls six months ago.

You don't control how it was gathered, but you also don't have to wait weeks or spend thousands to get it.

When Secondary Research Is the Smarter Move

Secondary research is not universal; it’s situational. But there are moments when it's not just useful - it's the only thing that makes sense.

1. Validating Hypotheses Before Committing

If you're considering a new market or product, secondary research can reveal demand, identify competitors, and show what has failed - saving you from the costly trial-and-error of others’ mistakes.

2. When You Need to Move Fast

Primary research takes time - weeks or months - but secondary sources let you assess market changes like funding rounds or regulatory shifts in days, not quarters.

3. Scanning for Blind Spots

Secondary research works well when you're trying to understand what you don't know yet. You're not testing a specific claim; you're mapping the terrain.

What are customers complaining about? What's being discussed in earnings calls? What are analysts predicting? You're listening, not interrogating.

4. When Internal Data Goes Untapped

Many companies have untapped secondary data in customer support tickets, sales calls, product feedback, and usage logs. It's already paid for - just not synthesized. Before launching a new study, check if the answers are already in your own systems.

Now that we know when secondary research makes the most sense, let’s look at where to find valuable data.

Sources of Secondary Market Research

Secondary data comes from two places: what your organization has already created, and what the outside world has published.

1. Internal Sources

These are records your business generates as part of normal operations. They're not designed for research, but they contain patterns.

- Sales and CRM data: What deals closed, which ones didn't, and what objections came up repeatedly.

- Customer support logs: Common complaints, feature requests, and product confusion points.

- Past research reports: Studies your team ran a year ago that are still relevant.

- Recorded calls and meetings: Conversations with customers, prospects, or internal strategy sessions that weren't initially analyzed.

- Website and product analytics: What people search for, where they drop off, and what content they engage with.

The advantage here is control. You know the context behind the data because you were part of creating it.

The downside is that it's limited to your own customers and operations, so it doesn't tell you what's happening outside your walls.

2. External Sources

These are published or available datasets created by others, often for different purposes.

- Government and regulatory databases: Census data, trade statistics, labor reports, industry classifications.

- Industry reports and analyst research: Gartner, Forrester, IBISWorld, McKinsey sector reports.

- Competitor filings and earnings calls: Public companies disclose strategy, risks, and performance data quarterly.

- Academic papers and journals: Peer-reviewed studies on market behaviors, consumer psychology, or emerging technologies.

- News archives and media coverage: What's being discussed, funded, criticized, or adopted in real time.

- Trade associations and market surveys: Organizations that track trends within specific industries or professions.

External sources give you breadth. They show you what's happening across markets, geographies, or customer segments you haven't reached yet.

But they're also noisy. Not every report is credible, and not every data point is recent or relevant to your situation.

How to Do Secondary Market Research (Practical Workflow)

If you’re doing secondary market research, don’t treat it like Googling for facts. Treat it like preparing to make a call that actually matters. The goal is to make a decision and not regret it later.

The workflow is straightforward:

- Step 1: Start with the decision, not the question

Don’t ask “What do customers think?” Ask, “What am I deciding?” Write the decision first, then list what would need to be true for each option. That tells you exactly what data matters and what’s just noise.

- Step 2: Be picky about sources

One solid source beats ten weak ones. Ask: Who created it? Why did they publish it? Can you defend it if someone challenges you? If you can’t explain where the data came from, don’t use it.

- Step 3: Look for patterns

Don’t just note what each source says - look for where they agree, clash, or repeat the same signal.

Repetition = signal. Contradictions = assumptions worth digging into. That’s where insight comes from.

- Step 4: Turn insight into action

Research isn’t done when you “understand the market.” It’s done when you make a move. Expand, pause, fix, invest, or kill something - pick one and tie it directly back to what the data showed.

With your insights in hand, the next step is deciding how to act on the signals you've identified.

Making the Call: What to Do With the Signals You Find

Data doesn’t make decisions, you do. But secondary research helps narrow down your options and makes decisions clearer.

- Maturing market: Decide whether you're defending your share or milking profits. If growth is slowing and competition is stable, expansion might not make sense. Focus on optimization and margin improvement instead.

- Competitors pulling back: Is this an opportunity or a warning? If they exit a segment, it could mean either a strategic move or a mismanagement issue. Check why they left - strategic shifts create opportunity, financial distress signals danger.

- Shifting demand: Not every trend deserves a response. If customer interest is moving toward something you don’t offer, ask: Is it a temporary spike or a long-term shift? Only chase trends that align with your core strengths.

- Conflicting findings: Don’t average conflicting reports. Dig into the methodology - one might be looking at revenue, the other at unit volume. The conflict itself tells you the market’s not uniform, so your strategy shouldn't be either.

By this point, the challenge is no longer finding signals - it’s working with the ones you already have.

Internal conversations often contain the clearest evidence: customer calls, sales discussions, support escalations, and internal reviews. The problem is structural. Spoken information is rich, but it fades quickly, resists comparison, and doesn’t compound unless it’s captured in a usable form.

This is where tooling matters - not to change how you research, but to prevent existing insight from disappearing.

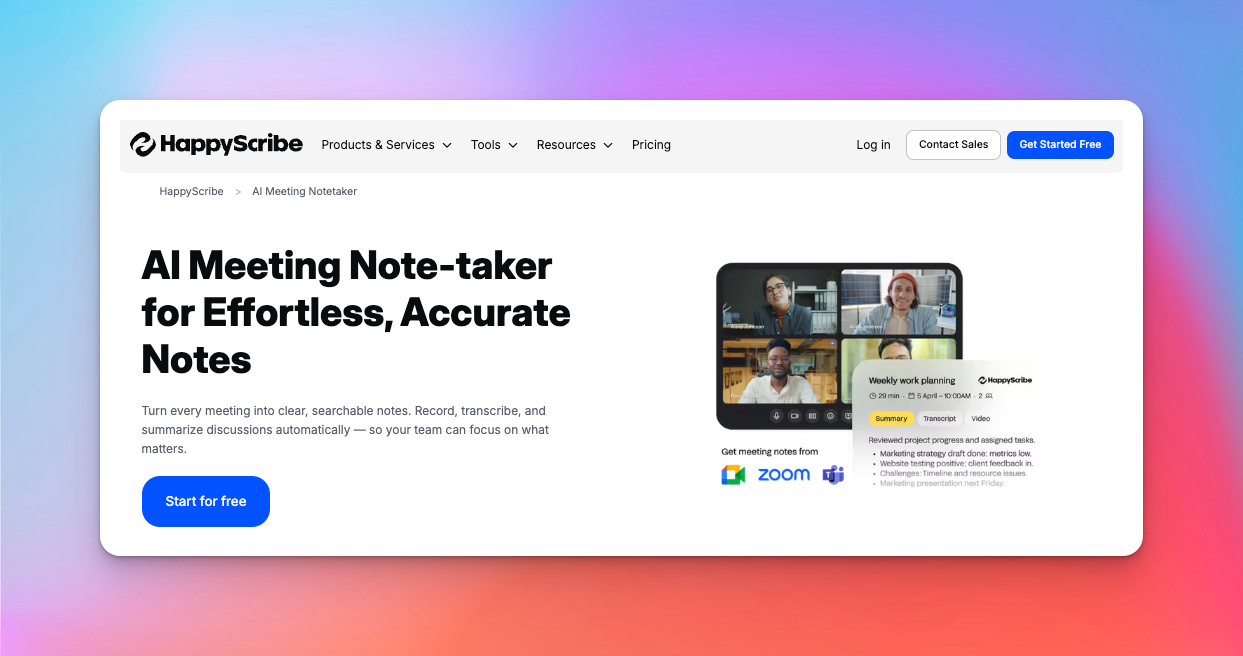

Where HappyScribe Supports Secondary Research

Most teams doing secondary research already have hours of recordings - customer calls, internal briefings, interviews, webinars. They count as existing data, but they’re difficult to use until you can read, search, or compare them.

HappyScribe doesn’t change how you research; it simply turns audio to text so spoken content becomes searchable, comparable, and reusable.

Here’s where it actually helps:

- Turning recordings into text you can analyze

AI Transcription converts audio or video into editable transcripts in 120+ languages, so you don’t have to rewatch anything to extract insight.

- Keeping multilingual inputs consistent

You can transcribe or translate recordings into a single working language without losing tone or meaning.

- Preserving the meeting context you didn’t plan to reuse

The AI Notetaker auto-joins calls via your Google or Outlook calendar, records them, labels speakers, and sends summaries - useful when internal discussions become relevant later.

- Finding patterns faster

You can search inside transcripts, highlight sections, leave comments, or use AI to pull themes or quotes across different files.

- Using human-verified text when accuracy matters

For anything going into reports, legal review, or publication, you can request a human-edited transcript for higher precision.

And the nice part is that once these transcripts exist, they stay useful long after the original conversation fades - which means your research base quietly grows without extra work.

You don’t need to chase every new insight. You need to understand what’s already in front of you. Secondary research isn’t just about adding to the pile - it’s about recognizing what’s been said, what’s been tried, and what’s ready to move you forward.

The answers aren’t hiding in another report or buried in a conversation you’ve missed. They’re scattered, waiting to be connected. But unless you can make sense of it all, it’s just noise.

That’s where HappyScribe changes the game. It doesn’t just give you the data - it turns it into something you can act on. Every call, every meeting, every conversation becomes a part of the bigger picture. No waiting. No searching. Just clarity, ready when you need it most.

Frequently Asked Questions

What is an example of secondary research?

An example of secondary research is using publicly available industry reports, like those from Gartner or IBISWorld, to analyze market trends and competitor strategies without conducting original research yourself.

What is primary and secondary market research?

Primary market research collects new data through surveys, interviews, or observations for specific questions. Secondary market research uses existing data, like government reports or industry studies, gathered for other purposes.

Which two sources are secondary market research?

Two key sources of secondary market research include government databases (such as census data or trade statistics) and industry analysis reports (from companies like McKinsey or Forrester).

Can secondary research be used for long-term planning?

Yes, it’s valuable for spotting long-term trends and macro-level market shifts, but it’s most useful for understanding broad forces rather than specific, short-term details.

Akshay Kumar

Akshay builds pieces meant to reach people and stay visible where it matters. For him, it’s less about the name and more about whether the words did what they were meant to.